XRP Price USD and Its Relevance in the Crypto Ecosystem

The world of cryptocurrency has been rapidly evolving over the years, with thousands of digital assets available in the market. One of the key players in the ecosystem is XRP, a cryptocurrency developed by Ripple Labs. XRP is known for its fast transaction speeds and low fees, making it an attractive option for both businesses and individual investors. In this article, we will explore the relevance of XRP in the crypto ecosystem, examine its price in USD, and investigate its correlation with XRP price USDT, the trading pair that has garnered significant attention.

What is XRP?

XRP is a digital currency that operates on the Ripple network, which was created by Ripple Labs. Unlike many cryptocurrencies, XRP is not based on a decentralized blockchain but operates on a consensus algorithm called the RippleNet protocol. Ripple Labs designed XRP to facilitate fast, low-cost, and scalable transactions for financial institutions, positioning it as a bridge currency in the cross-border payments sector.

The primary use case of XRP is to enable quicker and cheaper transactions between banks, especially for international payments. Unlike Bitcoin and Ethereum, which often experience high fees and slower transaction times, XRP’s consensus algorithm ensures that transactions are completed in just a few seconds with minimal fees.

XRP Price in USD: Historical Trends and Insights

Understanding XRP Price Trends Over the Years

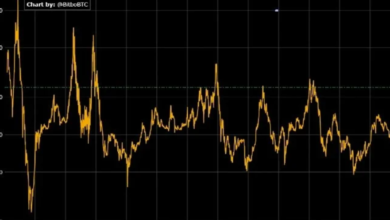

The price of XRP has been a subject of interest for many crypto investors and traders. XRP’s price in USD has fluctuated over the years, largely influenced by market trends, adoption, and regulatory factors. Historically, XRP has seen significant price spikes, such as during the 2017 cryptocurrency bull run when the price of XRP reached an all-time high of $3.84 in January 2018.

However, the journey for XRP has not been smooth. The price has often faced volatility, especially with the ongoing regulatory issues that Ripple Labs has faced with the U.S. Securities and Exchange Commission (SEC). The legal battles and uncertainties have at times caused XRP’s price to drop significantly. Despite these challenges, XRP continues to remain relevant in the crypto market due to its utility and the backing of Ripple Labs, a key player in the financial industry.

Current XRP Price in USD (2025)

As of 2025, the price of XRP in USD continues to show volatility but is increasingly stabilizing as the digital currency gains traction with mainstream financial institutions. The ongoing legal developments surrounding Ripple’s regulatory issues with the SEC are likely to influence XRP’s price fluctuations in the short term.

For those looking to track XRP’s value, various cryptocurrency platforms and exchanges provide up-to-date information on XRP price in USD, enabling investors to monitor trends and make informed decisions.

XRP Price USDT: Exploring the Trading Pair

What is XRP/USDT?

XRP price USDT refers to the trading pair where XRP is exchanged against USDT, also known as Tether. USDT is a stablecoin pegged to the US Dollar, which makes it a popular pairing for cryptocurrencies. The XRP/USDT pair is one of the most commonly traded pairs on various cryptocurrency exchanges. This pairing helps investors hedge against the volatility often associated with crypto markets by providing a stable reference value.

When analyzing XRP price USDT, traders look at how XRP’s value fluctuates relative to Tether, which stays close to the value of the US Dollar. This makes it easier for traders to assess XRP’s performance in relation to a relatively stable asset.

Impact of XRP Price USDT on the Market

The XRP price USDT pair has grown in relevance due to several factors:

- Liquidity: XRP/USDT is one of the most liquid trading pairs on exchanges. This means that traders can enter and exit positions quickly, making it an ideal trading pair for active traders.

- Market Sentiment: The price of XRP in relation to USDT provides a snapshot of market sentiment, offering a direct way to gauge the cryptocurrency’s relative strength in the market.

- Risk Management: As USDT is a stablecoin, the XRP/USDT trading pair provides a means for traders to mitigate risk by switching between volatile cryptocurrencies like XRP and a more stable asset.

Factors Influencing XRP Price USD and XRP Price USDT

Several factors influence the price of XRP, both in USD and USDT, which in turn affect the broader cryptocurrency ecosystem. Understanding these factors can help investors and traders anticipate price movements and make informed decisions.

1. Market Sentiment and News

The crypto market is highly sensitive to news, and XRP is no exception. Positive developments, such as new partnerships with financial institutions or positive regulatory news, can cause a surge in XRP price in USD and USDT. On the other hand, negative news, such as regulatory crackdowns or setbacks in Ripple’s legal battles, can cause a decline in its price.

2. Legal and Regulatory Developments

Ripple’s ongoing legal battles with the SEC have had a significant impact on the XRP price. The outcome of these lawsuits could determine whether XRP is classified as a security or a commodity, influencing its accessibility to institutional investors and the general public. Positive rulings could drive the price of XRP upwards, while unfavorable outcomes could lead to further price declines.

3. Adoption and Partnerships

XRP’s adoption by financial institutions plays a crucial role in determining its price. The more Ripple’s technology is used for cross-border transactions, the higher the demand for XRP. Ripple’s partnerships with major financial institutions, including Santander and PNC, contribute to the growing use case of XRP, which in turn drives its price higher.

4. Global Economic Factors

The global economic landscape, including inflation rates, interest rates, and economic crises, can also affect the price of XRP. For example, in times of economic uncertainty, cryptocurrencies like XRP may see increased demand as investors look for alternative assets that provide better returns or a hedge against fiat currency inflation.

XRP’s Relevance in the Crypto Ecosystem

XRP plays a crucial role in the broader cryptocurrency ecosystem, particularly in the realm of cross-border payments and decentralized finance (DeFi). Unlike other cryptocurrencies, XRP was specifically designed to serve the financial sector, making it an essential asset for facilitating efficient and low-cost transactions.

Ripple Labs, the company behind XRP, continues to innovate and expand its reach by working with central banks and financial institutions globally. The growing adoption of XRP for cross-border payments continues to affirm its importance within the crypto ecosystem.

XRP and the Future of Decentralized Finance

As decentralized finance (DeFi) continues to evolve, XRP’s role in the ecosystem will likely become even more prominent. With its quick transaction speeds and low fees, XRP has the potential to revolutionize the way financial transactions are conducted, especially in the global payments sector. Moreover, XRP could see more use cases in DeFi protocols that require efficient settlement layers.

FAQs about XRP Price USD and Its Relevance in the Crypto Ecosystem

1. What factors influence the price of XRP in USD?

The price of XRP in USD is influenced by market sentiment, adoption by financial institutions, regulatory news, and the broader economic environment.

2. How does XRP price USDT work?

XRP price USDT reflects the value of XRP when traded against Tether (USDT), a stablecoin. This pairing helps provide stability and liquidity for traders.

3. Can XRP’s price be affected by Ripple’s legal issues?

Yes, Ripple’s ongoing legal issues with the SEC have caused significant fluctuations in XRP’s price. A positive outcome could boost the price, while a negative outcome could lower it.

4. Is XRP a good investment in 2025?

XRP’s price prospects in 2025 will depend on legal developments, adoption by financial institutions, and its integration into the broader crypto ecosystem. Investors should conduct thorough research and consider potential risks before investing.

5. How can I track XRP’s price?

You can track XRP’s price on various cryptocurrency exchanges or financial websites that offer real-time market data.

6. What is the difference between XRP price in USD and XRP price USDT?

XRP price in USD is the value of XRP when traded against the US Dollar, while XRP price USDT refers to the value of XRP when traded against the stablecoin Tether (USDT).

Conclusion

XRP remains one of the most significant and influential cryptocurrencies in the market today. With its focus on cross-border payments, its value in USD, and its relevance in the crypto ecosystem, XRP continues to be a driving force in the blockchain space. Although its price is impacted by various factors, including legal challenges and market conditions, its utility and growing adoption by financial institutions position XRP as a key asset for the future of digital finance. Whether you are a seasoned investor or new to crypto, understanding XRP price USD and XRP price USDT is crucial to navigating the ever-changing landscape of the cryptocurrency market.