Bitcoin Price Analysis: Understanding Valuation Models and Market Signals

Foundations of Bitcoin Price Analysis

The bitcoin price reflects a combination of technological fundamentals, market psychology, and economic conditions. Unlike traditional assets, Bitcoin valuation relies on network activity, scarcity, and adoption rather than cash flow or earnings.

Price analysis helps investors interpret market behavior by identifying patterns that suggest long-term value development rather than short-term speculation.

Scarcity and Supply-Based Valuation

Bitcoin’s fixed supply plays a central role in its valuation framework. With only 21 million coins available, scarcity increases as adoption grows. This limited supply structure creates upward pressure on price when demand expands.

Models based on scarcity focus on supply reduction events and circulation dynamics. These factors help explain long-term bitcoin price appreciation across market cycles.

Network Growth and Adoption Metrics

Network growth provides valuable insight into bitcoin price behavior. Metrics such as wallet activity, transaction volume, and hash rate reflect usage and security strength.

As network participation increases, confidence in the system strengthens. This growing trust supports valuation stability and reinforces Bitcoin’s long-term market position.

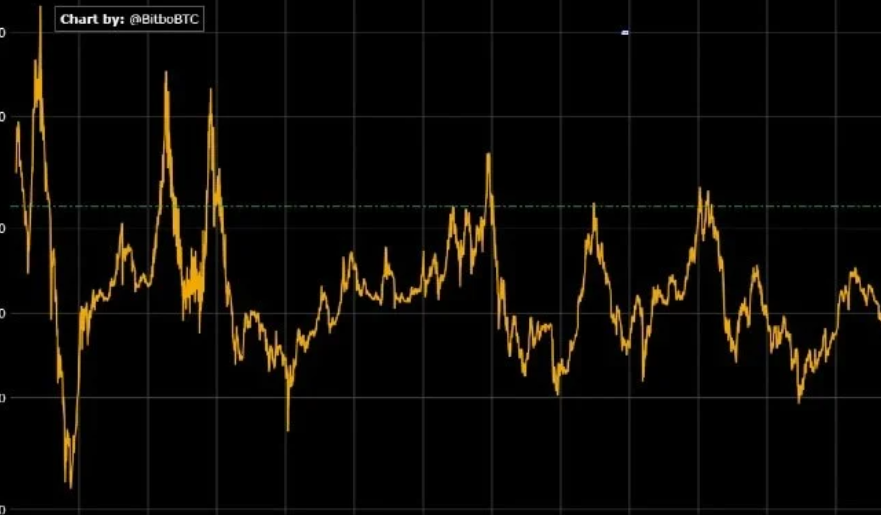

Technical Indicators and Market Signals

Technical analysis plays an important role in understanding price momentum. Moving averages, trading volume, and trend strength indicators help identify periods of accumulation or distribution.

While technical signals are often used for short-term decisions, they also contribute to broader market understanding by highlighting changes in investor behavior.

Role of Institutional Participation

Institutional investment has introduced more structured trading behavior into the Bitcoin market. Larger capital inflows improve liquidity, reduce extreme price swings, and enhance price discovery.

Institutional involvement signals market maturity and strengthens long-term confidence in bitcoin price sustainability.

Limitations of Price Models

No valuation model can fully capture bitcoin price behavior. Market sentiment, regulatory developments, and unexpected economic events can override technical or fundamental signals.

Recognizing these limitations encourages balanced analysis and realistic expectations rather than reliance on a single predictive approach.

Long-Term Market Interpretation

Over time, bitcoin price analysis has shifted from speculation toward fundamentals. Adoption growth, infrastructure development, and regulatory clarity continue to shape valuation trends.

This transition supports a more resilient and transparent market environment capable of sustaining long-term value creation.

Conclusion

The bitcoin price is influenced by scarcity, network growth, market signals, and institutional participation. Understanding valuation frameworks and their limitations allows for more informed interpretation of market movements.

A structured approach to analysis highlights Bitcoin’s evolving role as a digital asset with increasing relevance in the global financial system.